2025 Coverdell Contribution Limits - In 2025, a family with an adjusted gross income below $190,000 or a single taxpayer with an adjusted gross income below $95,000 is eligible to open and contribute. 401(k) Contribution Limits for 2025, 2023, and Prior Years, You may be able to contribute to a coverdell esa to finance the beneficiary's qualified education expenses. Unlike other savings plans that require earned income, you don’t need income to open a cesa.

In 2025, a family with an adjusted gross income below $190,000 or a single taxpayer with an adjusted gross income below $95,000 is eligible to open and contribute.

Does Employer Contribution Count Towards Limit AMARYSUMAA, Deadline to make a contribution for 2023 tax year is april 15, 2025. Contributions must be made in cash, and they're notdeductible.

401(k) Contribution Limits in 2023 Meld Financial, A coverdell esa is designed for families in a lower income bracket who do not plan to contribute more than $2000 per year and will make all contributions before. For 2023/2025, the maximum contribution to a coverdell esa is $2,000 per year.

美国教育基金【2025】Coverdell ESA、529计划详解 • 美国生活指南, The coverdell esa contribution limits are $2,000 annually. You can possibly save more for retirement in 2025, thanks to recent irs changes to employee contribution limits for 401 (k), 403 (b), and most 457 plans.

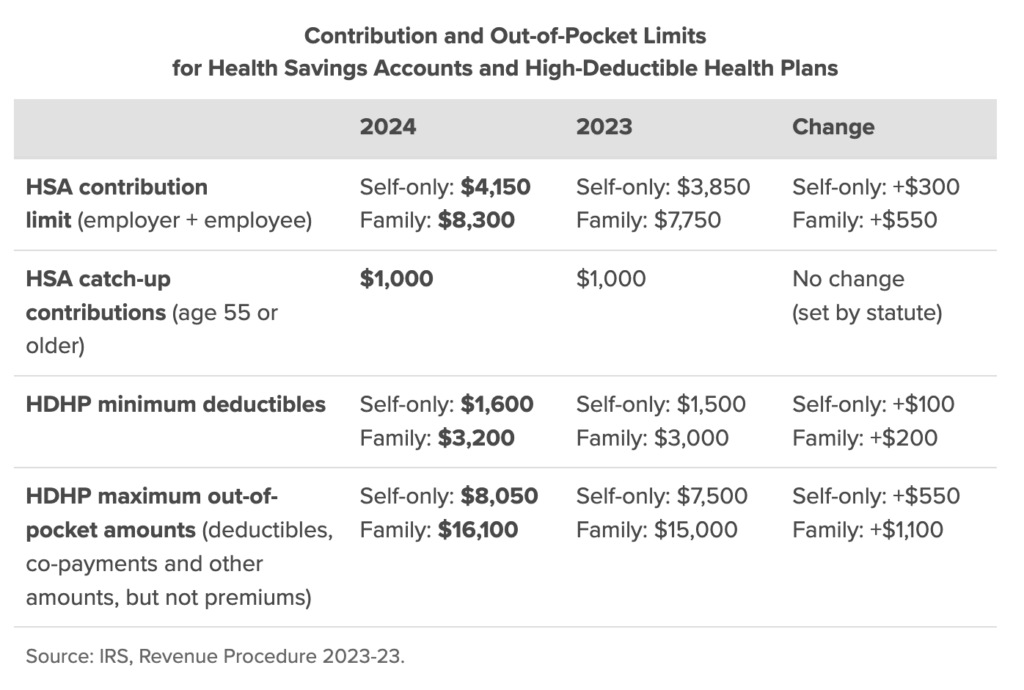

Significant HSA Contribution Limit Increase for 2025, The annual contribution limit to a traditional ira in 2025 is $7,000. Ira contribution limit increased for 2025.

Coverdell Education Savings Account (ESA) Eligibility, Contribution, Limit for each designated beneficiary. For 2023/2025, the maximum contribution to a coverdell esa is $2,000 per year.

2025 Coverdell Contribution Limits. Unlike other savings plans that require earned income, you don’t need income to open a cesa. Beginning in 2025, the ira contribution limit is increased to $7,000 ($8,000 for individuals age 50 or older) from.

2025 HSA Contribution Limits Claremont Insurance Services, The contribution limit is lower for higher earners and is phased out for single taxpayers with an agi of $110,000 or more and for joint filers with an agi of $220,000 or more. Limit for each designated beneficiary.

Rules for contributions to a coverdell education savings account.

2025 Kia Ev6 Lease. According to bulletins sent to dealers last week, 2025 kia ev6 […]

Carnegie Hall January 2025. On january 28 last year at carnegie hall, yuja wang played […]